Please refer to the Payment & Financial Aid page for further information. Together, these line items make up total shareholders’ equity. Everything listed is an item that the company has control over and can use to run the business. Assets are the stuff that a business owns that have value. You can think of them as resources that a business controls due to past transactions or events. Liabilities are owed to third parties, whereas Equity is owed to the owners of the business.

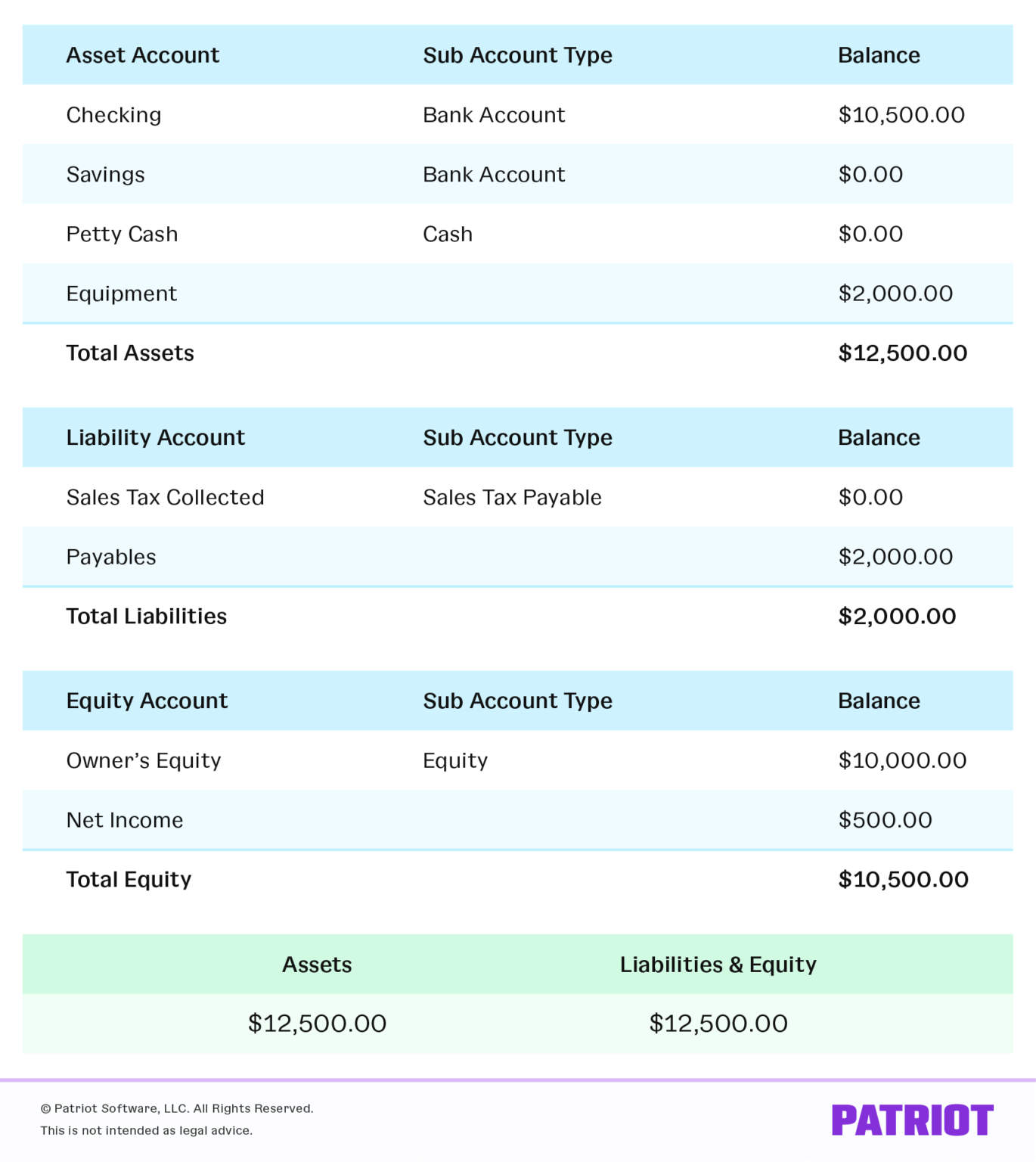

Assets Always Equal Liabilities Plus Equity

In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

Basic Accounting Equation: Assets = Liabilities + Equity

The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based on the idea that each transaction has an equal effect. It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit.

- The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet.

When Should I Use the Basic Accounting Equation?

This change must be offset by a $500 increase in Total Liabilities or Total Equity. Our popular accounting course is designed for those with no accounting background or those seeking a refresher. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7.

Whatever happens, the transaction will always result in the accounting equation balancing. The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded 9 ways to finance a business to represent the amount now owed to the supplier. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard.

What are the limits of the accounting equation?

Depreciation of an asset can be allocated variably, depending on the point of view of the person assessing the asset. Balance sheets can be “window dressed” by burying losses or pumping profits to present a better financial position. $10,000 is debited to cash, and $10,000 is credited to equity because it’s owed to Jim.$30,000 is also debited to cash, and $30,000 is credited to liabilities because it’s owed to the bank. But it has inventory, so you have to reflect that in your balance sheet. Revenues and expenses are often reported on the balance sheet as “net income.” Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet.

Under the double-entry accounting system, each recorded financial transaction results in adjustments to a minimum of two different accounts. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market. The accounting equation is fundamental to the double-entry bookkeeping practice. Its applications in accountancy and economics are thus diverse. Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.

This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. A company’s quarterly and annual reports are basically derived directly from the accounting equations used in bookkeeping practices. These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements.

If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. Options trading entails significant risk and is not appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies.

In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them. Building on the previous example, suppose you decided to sell your car for $10,000.